Welcome to the Hot Springs County, Wyoming County Treasurer Department

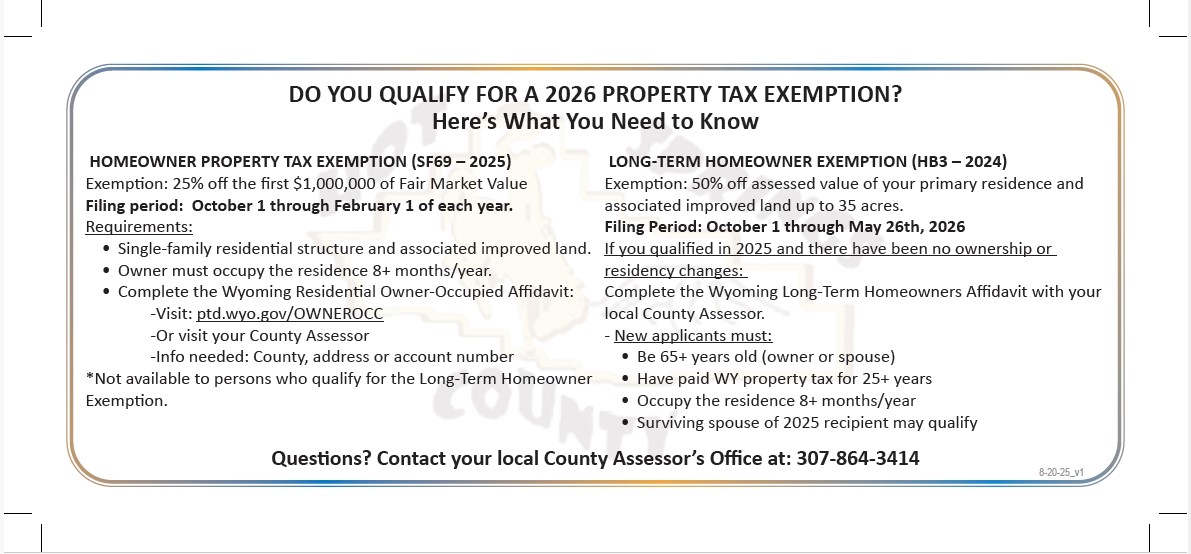

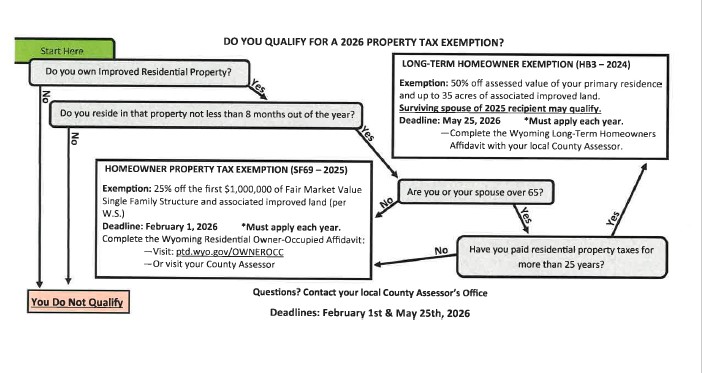

PROPERTY TAXES:

Property taxes in Wyoming run approximately nine months in arrears. Taxes are assessed as of January 1st. That means in accordance with state statute, that the name of the owner as of that date must be noted on the tax bill, even if the property is sold prior to the bill coming out. You should expect to receive your tax bill around the 1st week of September each year. Tax bills are always sent directly to taxpayers. Mortgage companies are provided tax information at their request.

If you have a question regarding the payment of taxes, please contact our office.

If you have a question regarding property value, Veteran's Exemptions, ownership or address corrections, please contact the County Assessor.

________________________________________________________________________________________________________________________________

*We are currently in the process of streamlining our online payment system. If you are unable to add your taxes to the payment cart, please utilize our pay by phone system.

Call: (877) 690-3729, and when prompted type in jurisdiction code 5990. This will link you to your bill. At this point you can type in your six digit parcel number or Local ID. If looking at your tax bill, it is the first six digits at the top right of the statement that are in blue.

____________________________________________________________________________________________________________________________

_____

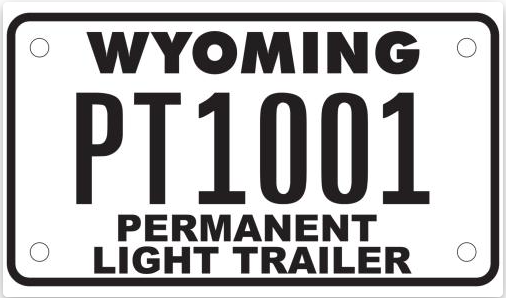

Starting July 1, 2023 owners of light trailers – defined as trailers weighing less than 1,000 lbs. – may purchase a permanent plate for their trailer.

Light trailers that are less than 6 years old would incur a $350 one-time permanent registration fee for the plate.

To register older trailers, owners will need to pay a $50 one-time administration fee, a one-time fee equal to 5-times the county registration fee that would be due at 6 years of service, and a one-time fee equal to 5-times the state registration fee.

For example, if you currently pay $12.50 for your yearly registration fee on a lightweight trailer, you would pay the $50 administrative fee plus $12.50 x 5 = $62.50. Your total fee would then be $112.50.

If the trailer is sold, the plate expires and the customer must remove the plate. Plates cannot be transferred to a new owner.

Does your license plate look like the one displayed below? If so, your plate is expired. Please visit us today!

Not a fan of the new Wyoming state flag design? That's OK. The state has sepcialty plate designs available for purchase. We have three of those designs available in office. Come see us to purchase one of the following:

Wildlife Conservation Plate

Search and Rescue Plate

Wyoming Rodeo Plate

Other specialty plates are available online. Visit the link below.

https://www.dot.state.wy.us/home/titles_plates_registration/specialty_plates.html

AUCTION FOR LOW NUMBERED PLATES: UNIVERSITY OF WYOMING ALUMNI, SEARCH AND RESCUE, AND RODEO

* Low Numbered Plate Auctions

UW is auctioning off the lowest 10 numbers in each county.

The UW Alumni Association is auctioning off a rare opportunity: the 10 lowest available UW license plate numbers in every Wyoming county. These plates don’t come around often—and once they’re gone, they’re gone.

How did these plates become available?

At the end of 2025, unrenewed UW plates were released, opening the door for UW alumni and friends to claim these coveted low numbers.

How the auction works:

- Online-only auction

- 10 days total

- One plate per day, per county (23 plates daily)

- 24 hours for each number and bidding runs noon to noon

- Auction kicks off Feb. 18

- Lowest numbers launch first, with the final (10th lowest) plates closing on Feb. 28

Visit the link below for additional information.

https://www.pokes.org/license-plates

WYDOT is auctioning off 12 Search and Rescue plates to raise money for the Search and Rescue Fund. These plates will be auctioned in stages via the Public Surplus site. Each stage will be open for bids for two weeks. If you do not already have an account, we encourage you to register now using the link at the bottom of the section.

-

- Lot 1 Feb 9th through 23rd - Plates #1-#5.

- Lot 2 Feb 10th through 24th - Plates #6-#10.

- Lot 3 Feb 11th through 25th - Plates #100 and #307.

- Auction is open to any person required to register a vehicle in Wyoming;

- Plates will be sent to the county treasurer where they will register the vehicle;

- In addition to the auction price, the plate requires a payment of $180 ($30 Specialty Plate fee and $150 SAR fee) + any standard registration fee due;

-

-

- Will need to surrender their current plate if simply putting it on an existing vehicle with a current registration.

-

-

- $50 annual fee will apply in subsequent years.

- Auction will be held: Wyoming Surplus

- Rodeo Plates will be auctioned off by each rodeo program. Each college wants to auction off ONE plate #, specific to their county. Additional information forthcoming.

Specialty and Prestige Plates - Effective immediately, WYDOT is releasing all low-numbered specialty and prestige plates that were not reordered by January 31, 2026. These plates are now available on a first-come, first-served basis.

Important Documents

Downloads: 1414 | Size: 7.04 KB

Downloads: 1119 | Size: 42.39 KB

Downloads: 1470 | Size: 12.18 MB

Downloads: 770 | Size: 52.43 KB

Downloads: 964 | Size: 14.95 MB

Downloads: 702 | Size: 44.48 KB

Downloads: 961 | Size: 14.26 MB

Downloads: 664 | Size: 51.18 KB

Downloads: 790 | Size: 14.83 MB

Downloads: 600 | Size: 48.35 KB

Downloads: 778 | Size: 14.51 MB

Downloads: 538 | Size: 52.22 KB

Downloads: 678 | Size: 13.45 MB

Downloads: 320 | Size: 53.29 KB

Downloads: 547 | Size: 215.92 KB

Downloads: 154 | Size: 4.81 MB

Downloads: 154 | Size: 2.95 MB

Downloads: 106 | Size: 54.38 KB

Downloads: 186 | Size: 219.72 KB

Downloads: 185 | Size: 15.53 MB

Downloads: 1312 | Size: 8.27 KB

Downloads: 1139 | Size: 102.22 KB

Important Links

The following links may be helpful to you in researching Motor Vehicle or Property Tax issues.

Vehicle sales tax exemption for tribal member now only applies if the sale occurs on the Wind River Indian Reservation.

The Treasurer’s office will require evidence that the property was delivered by the seller to a location on the Wind River Indian Reservation. Acceptable evidence will be a shipping document provided by the common carrier or an Affidavit Of Delivery.

The Wyoming Department of Revenue is requesting that the Affidavit of Delivery be placed on company letterhead and the purchaser has to sign it as well.This also applies to person-to-person sales.

Requirements to license a vehicle:

Wyoming Title - proof of insurance on motorized vehicles - proof that the vehicle was registered in another state to you or proof that you paid sales tax. If this is a new purchase, you will be charged sales tax based on the rate in effect in your Wyoming place of residence. Sales tax must be paid within 65 days of purchase or be subject to penalty and interest on the tax amount.

Motor Vehicle county fees are based on the original MSRP (factory price) of the vehicle from the factory to the dealer: year, make, model and trim package.

This gives the valuation which is then multiplied by 3% which gives the county fee. This fee is an ad valorem tax in lieu of property tax. The state fee is a flat fee of $30.00 for passenger vehicles. Trucks, trailers, motor home`s and campers state fee is based on weight.

Example: Brand new car factory price $35,000.00 x 60% = $21,000 x 3% = County fee $630.00. This fee is pro-rated downward for the first 6 years of the life of the vehicle till the formula would be $35,000.00 x 15% = $5250.00 x 3 % County fee $157.50. The % is as follows: 60% - 50% - 40% - 30% - 20% - 15%

Please feel free to contact us to receive assistance in calculating your registration fees.

As you can see the more expensive your vehicle the more it costs to license in Wyoming. Wyoming is not cheap when it comes to motor vehicle fees. Please contact us for more information if you plan to move to our state.

As per Wyoming Statute 31-2-201, registration is required immediately upon becoming a resident in the case of a previous nonresident owner.